SEARCH FOR PROPERTIES NOW...

Student

Professional

10,012 Leeds Homeowners Let Down: The Silent Scandal of Estate Agents Overvaluing

If you have ever thought about selling your Leeds home, chances are you have been tempted to push the asking price a little higher than advised. After all, it’s your biggest tax free asset. A few extra thousand on the asking price of your Leeds home sounds like a smart move, doesn’t it?

But here’s the rub: in property, chasing too much can often mean getting nothing at all.

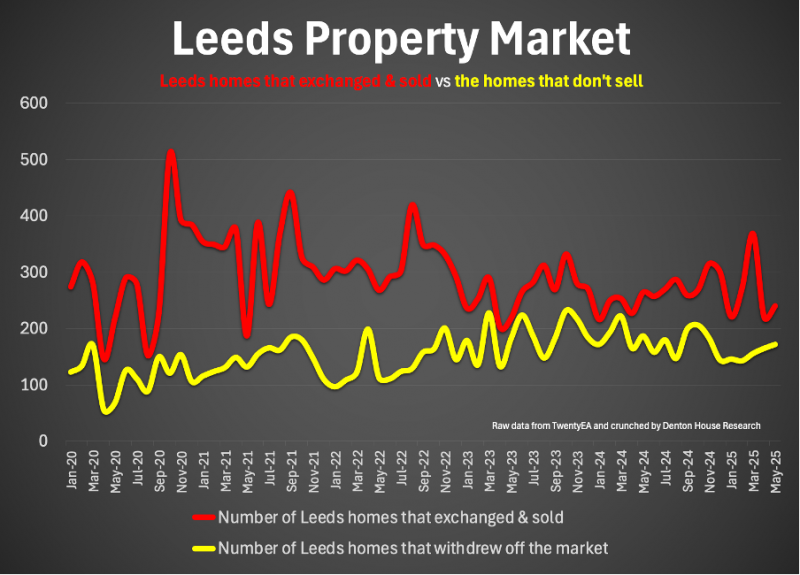

Since the start of 2020, over 10,012 homes, listed for sale in Leeds were withdrawn from the market unsold. And while some may blame timing or market conditions, in many cases the underlying problem is much simpler, the asking price was too high from the outset.

Let us explore how this has unfolded, why it’s happening, and most importantly, what you can do as a Leeds homeowner to avoid falling into the same trap.

The Temptation to Overprice and Why it Backfires

When estate agents come round to pitch for your business, it’s not uncommon to hear different figures. One might suggest £285,000. Another £300,000. Then someone walks in and says £325,000, no hesitation, no caveats.

It’s flattering. It’s exciting. And it’s often a trap.

Some agents know exactly what figure will win your instruction, even if it has little grounding in what the market will pay. They don’t need to sell the home straight away they just need it on the books.

Once it’s listed onto the market, often tying in the homeowner to a sole agency contract for 20 or even 26 weeks, they can work on reducing the price over time. Meanwhile, your ideal buyer may have dismissed it from the get-go as overpriced.

The Leeds Numbers Don’t Lie

Let’s look at the hard data for the LS1 through to LS12 postcode districts. Of the homes that left Leeds estate agent’s books, what percentage of them withdrew from the market without selling?

2020

- Of the 4,880 Leeds homes that came off agent's books:

- 3,471 of them sold & exchanged contracts (i.e. the homeowners moved),

- and the remaining 1,409 of them didn’t sell (i.e. 28.9% failed to move home).

2021

- Of the 5,730 Leeds homes that came off agent's books:

- 3,972 of them sold & exchanged contracts,

- and the remaining 1,758 of them didn’t sell (i.e. 30.7% failed to move home).

2022

- Of the 5,508 Leeds homes that came off agent's books:

- 3,835 of them sold & exchanged contracts,

- and the remaining 1,673 of them didn’t sell (i.e. 30.4% failed to move home).

2023

- Of the 5,442 Leeds homes that came off agent's books:

- 3,209 of them sold & exchanged contracts,

- and the remaining 2,233 of them didn’t sell (i.e. 41.0% failed to move home).

2024

- Of the 5,324 Leeds homes that came off agent's books:

- 3,167 of them sold & exchanged contracts,

- and the remaining 2,157 of them didn’t sell (i.e. 40.5% failed to move home).

2025 YTD

- Of the 2,103 Leeds homes that came off agent's books:

- 1,321 of them sold & exchanged contracts,

- and the remaining 782 of them didn’t sell (i.e. 37.2% failed to move home).

In total, that’s 10,012 homes in Leeds since January 2020 that came to market yet never sold. Most of those were overvalued and withdrawn in frustration. Nearly all were likely overpriced in comparison to what buyers were willing to pay at the time.

This is not a coincidence. It’s a pattern.

The Real Consequences of Overvaluing

Overpricing doesn’t just delay a sale, it can wreck it completely.

Leeds properties that sit on the market too long become “stale”. Buyers start asking questions. Why hasn’t it sold? What’s wrong with it? Are there problems with the neighbours? Is there a structural issue?

Even when the price is eventually reduced to a realistic level, the damage is done. It now competes with fresher listings that appear more desirable, even if yours is the better home.

And here’s the painful truth: in many cases, many Leeds homes that were originally overpriced end up selling for less than if they had been marketed correctly in the first place.

The Risk of a Sale Falling Through

Let’s say you do get a buyer eventually for your Leeds home after dropping your asking price after three or four months.

Did you know that how long it takes to find a buyer can directly affect your chances of moving home?

According to independent data from Denton House Research and TwentyEA:

- Homes that go under offer (i.e. sale agreed) within 25 days of coming onto the market have a 94% success rate of subsequently exchanging contracts & completing (i.e. move home).

- Homes that sit on the market for over 100 days before agreeing a sale, the success rate of that sale agreed home subsequently getting to exchange & completion (i.e. move home) drops to 56%.

If that doesn’t scream “price it right from the start”, I don’t know what does.

Why Do Leeds Estate Agents Still Overvalue?

If overvaluing causes so many issues, why do some agents keep doing it?

Simple: pressure. Some corporate and larger estate agencies measure success not by what they sell, but by how many homes they put onto the market. There are even some estate agency models where staff are bonused just for signing someone up to list their home for sale, regardless of the outcome.

When that’s the goal, accuracy takes a back seat. Telling sellers what they want to hear becomes more profitable to their commission cheque, than telling them the truth.

This “listing at all costs” culture has created a false economy. Homes get listed high, then chipped down over months, often ending in failure. Meanwhile, the agent has fulfilled their quota, and the homeowner is left disappointed.

Four Ways to Avoid the Overpricing Trap

So how do you protect yourself as a Leeds homeowner?

1.Get more than one opinion

Don’t rely on a single valuation. Invite two or three Leeds agents round, and if one quote seems suspiciously high, ask for evidence. Ask what percentage of the homes they list, do the homeowners subsequently move home (i.e. sell, exchange & complete).

2.Do your homework

Look at what Leeds homes similar to yours have sold for recently, not what they are listed at now. Portals like Rightmove, Zoopla, and OnTheMarket let you check “sold subject to contract” properties. Over the past two years, the average sale price agreed has consistently ranged between 98.7% and 99.1% of the asking price at the time the offer was accepted (not the original asking price). This highlights how realistic pricing draws in committed buyers.

3.Understand Leeds market trends

Prices rose rapidly in 2021 and early 2022, but we’re not in that climate anymore. Don’t base your expectations on a market that no longer exists.

If you're considering selling, take a moment to check the property portals for homes like yours in your area. Compare how many are currently for sale versus how many are marked as ‘Sold Subject to Contract’ as this ratio reveals the market’s direction. If over 40% are Sold STC, it’s a sellers’ market. If it drops below 30%, buyers hold the upper hand. Also, follow my Leeds property blog for weekly updates on our local property market.

4.Choose a Leeds estate agent with integrity

A good estate agent will back up their valuation with evidence. They will explain their reasoning, and focus on the end result, a completed sale, not just listing the property. Also, be aware of agents that sign you up for long sole agency agreements of 20 even 26 weeks.

Don’t Fall for the Fantasy Asking Price of your Leeds Home

Overvaluing may feel like a harmless gamble. It’s not. It’s the quickest way to burn time, lose buyers, and even end up with less than if you’d priced realistically from the start.

The Leeds property market has spoken: thousands of homes have failed to sell in the last 5 years, not because of lack of demand, but because they were priced out of it. This isn’t about doom mongering, it’s about telling the truth, so Leeds home sellers have a fighting chance of success.

Whether you're upsizing, downsizing or relocating entirely, make sure you get the advice you need, not just the advice you want to hear.

Final Thoughts for Leeds Homeowners

You only get one chance to make a first impression in the property market. Price it right and you attract serious buyers quickly. Get it wrong and your property can linger, lose appeal, and eventually fall by the wayside.

10,012 Leeds homeowners have experienced that frustration since 2020. Don’t become the next statistic.

Back to news