SEARCH FOR PROPERTIES NOW...

Student

Professional

Asking Price vs Sale Price - What Leeds Sellers Need to Know

Setting the right asking price is one of the most critical decisions when selling a home, particularly in the dynamic Leeds property market. The asking price not only influences how quickly your property sells but also determines the level of buyer interest and the final sale price. Getting it right from the outset can make the difference between a swift, successful sale and a prolonged, frustrating process.

In Leeds, where the average house price was £243,000 in February 2025, up 6.4% from the previous year, the market is competitive yet sensitive to pricing accuracy. Overpricing can deter potential buyers, especially in a market where around a quarter of sellers have reduced their asking prices in recent months to attract interest.

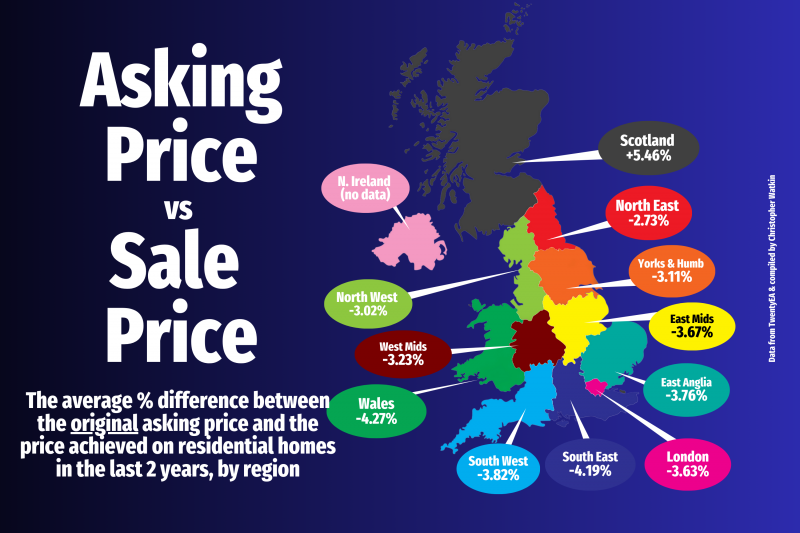

This data reveals the average difference between the original asking price and the final sale price achieved over the past two years for UK house sales. It highlights a clear trend across the UK where most homes sell for less than their initial asking price. Yet averages only tell part of the story.

It must be noted that Scotland has slightly different way of buying property as homebuyers often bid over the asking price, not under … a key distinction.

In England & Wales, realistic pricing is the key to success. This doesn’t mean pricing high at the start never works. Sometimes a seller lands a dream buyer and achieves more.

But in the main, properties priced too high often linger on the market which can lead buyers to assume there’s an issue with the property, further reducing its appeal. Research shows that homes requiring price reductions are 10% less likely to go under offer, and the likelihood of a sale falling through nearly doubles. If it takes more than 100 days to sell your property, there's only a 56% chance it’ll go on to exchange and complete. Whereas if your property sells within the first 25 days, that increases to a 94% chance!

Yes, you can try a higher asking price. But if you haven’t had strong interest or offers within the first few weeks, it’s not a sign to wait longer, it’s a sign to act.

Obviously under-pricing risks leaving money on the table. In Leeds, where semi-detached properties sell for around £281,824 and detached homes fetch £491,235, setting a price too low could mean missing out on thousands of pounds.

However, a strategically competitive price can spark interest and even trigger multiple offers, potentially driving the final sale price higher. For instance, pricing at or slightly below market value can create urgency, especially for first-time buyers and investors seeking value in the Leeds market.

There’s also the importance of local knowledge. With micro-markets varying across postcodes, and even within neighbourhoods, pricing must reflect comparable sales, property condition, and unique features like proximity to good schools or recent renovations.

Ultimately, setting the correct asking price in Leeds requires balancing market data, local trends, and your goals. By pricing realistically from the start, you maximize interest, minimize time on the market, and increase the likelihood of achieving a sale price that reflects your home’s true value.

In a market as vibrant as Leeds, getting the price right is not just a strategy—it’s the foundation of a successful sale.

Back to news