SEARCH FOR PROPERTIES NOW...

Student

Professional

Leeds Property Market - September 2025

Are you considering moving home in Leeds during the next 6 to 12 months?

You may be a Leeds landlord deciding whether to grow your portfolio or sell off a few properties. Or you're a Leeds first-time buyer wondering if now is the right time to move.

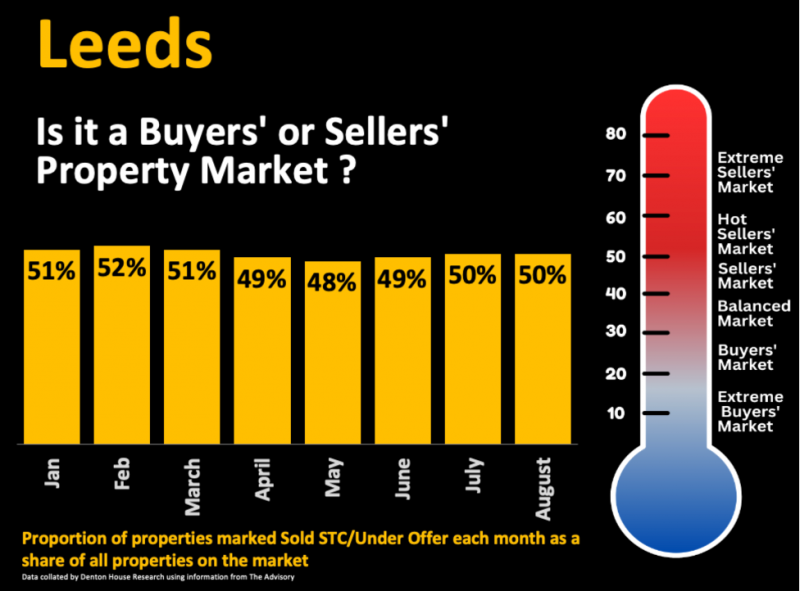

Understanding whether the current property market favours buyers or sellers is key to making the right call. If you follow my regular Leeds property updates, you'll know one of the most reliable ways to assess the market is by looking at the percentage of homes marked as "Sold STC" or "Under Offer" compared to the total number of properties on the market.

Let's show that in practice. In this example, if there are 400 properties on the market in a location, and say 300 properties are for sale, fully available to buy, and the remaining 100 are under offer or sold. 100 as a percentage of 400 gives us a sales percentage of 25%. It is this percentage that strongly indicates the local property market temperature and who holds the upper hand, i.e. buyers or sellers (or somewhere between).

This percentage figure acts as a barometer for market conditions and can be analysed using this table:

- Extreme Buyers' Market (0%-20%)

- Buyers' Market (21%-29%)

- Balanced Market (30%-40%)

- Sellers' Market (41%-49%)

- Hot Sellers' Market (50%-59%)

- Extreme Sellers' Market (60%+)

How Does Leeds Compare?

Examining historical data from The Advisory's website, which has tracked this metric for years, reveals some key trends for each month in 2025. (For this exercise, Leeds is LS1-LS12).

- January 2025 - 51% of properties were marked as Sold STC or Under Offer. This placed the market in the hot sellers’ market category, setting a strong opening point for sellers.

- February 2025 - 52% was recorded. The market stayed in the hot sellers’ market category. Compared with January, this was a slight rise, giving sellers a modest additional advantage.

- March 2025 - 51% meant the market remained in the hot sellers’ market category. Compared with February, this was a small dip, reflecting stability rather than change.

- April 2025 - 49% was recorded. This placed the market in the sellers’ market category. Compared with March, the figure was a little lower, giving buyers slightly more breathing room.

- May 2025 - 48% was recorded. The market stayed in the sellers’ market category. Compared with April, this was a small decline, highlighting the need for accurate pricing.

- June 2025 - 49% kept the market in the sellers’ market category. Compared with May, this was a slight improvement in favour of sellers.

- July 2025 - 50% was recorded. The market moved back into the hot sellers’ market category. Compared with June, this was a small increase, giving sellers a firmer advantage again.

- August 2025 - 50% was recorded. The market stayed in the hot sellers’ market category. Compared with July, the figure was unchanged, pointing to steady conditions.

Overall trend: From January to August 2025, the Leeds property market ranged between 48% and 52%. The market has consistently sat at the stronger end of conditions, mainly within the sellers’ market and hot sellers’ market categories. The trend shows stability, with only small monthly shifts, and sellers have held a steady advantage throughout the year.

These percentage figures are an average of the Leeds postcodes (as noted above).

For interest, if I break down the August 2025 figure by individual Leeds postcodes, it actually tells an even more interesting story…

- LS1 – 31%

- LS2 – 29%

- LS3 – 57%

- LS4 – 57%

- LS5 – 60%

- LS6 – 52%

- LS7 – 59%

- LS8 – 57%

- LS9 – 38%

- LS10 – 47%

- LS11 – 58%

- LS12 – 54%

Look at the difference between the postcodes!

So, what does a 50% "Sold STC to total stock" ratio mean for Leeds right now?

It places the local market on the cusp of a hot sellers’ market, giving sellers an advantage and meaning buyers need to bring their best game.

For Leeds Sellers

We are firmly in a market where patience, presentation, and accurate pricing matter more than ever. Buyers now have a choice, a lot of choice. Simply listing your property and hoping for the best will not cut it.

The homes that sell are those that hit the market with the right price from day one, have high-quality photography, clear floor plans, strong virtual/video tours, and marketing that stretches both online and offline.

Overpricing is the fastest way to stall a sale. Properties that linger usually face price reductions, lose momentum, and invite lower offers. In some cases, that even leads to failed sales before the exchange.

Getting it right at launch is critical.

The good news is the recent interest rate cut provides a welcome tailwind as first-time buyers are seeing lower monthly payments, encouraging more of them into the market and strengthening chains. Also, home movers can access better fixed-rate deals, helping them upsize, remortgage, and release more homes onto the market to buy. Finally, buy-to-let investors in Leeds's stronger-yielding areas may see the sums stacking up again.

Buyer sentiment is shifting. Rate cuts show the Bank of England wants growth and stability, which converts hesitant "wait and see" buyers into active "let's book a viewing" buyers.

This is not a one-off. The cut follows earlier reductions since late 2024. This means mortgage rates are more palatable, with some two-year fixes, at the time of writing, being below 3.75% on a 60% loan-to-value (LTV) basis, and an impressive 3.86% on a 5-year fixed (60% LTV). For first-time buyers with a 5% deposit, a 3-year fixed 4.78% rate on a 95% LTV mortgage looks pretty fair.

For Leeds Buyers

The market is calmer than the frenzy of 2021 and 2022. There is time to think, compare, and in some cases negotiate. That does not mean you can wait indefinitely or fire in lowball offers. The best homes are still competitive, but opportunities exist if you are open-minded and look beyond the most sought-after postcodes. Have your mortgage agreement in principle ready before making an offer. It sets you apart and gives sellers confidence. Also, consider widening your search area, as value is often found just beyond the obvious hotspots.

Final Thoughts on the Leeds Property Market

With inflation rising slightly (meaning interest rates won’t be coming down too much in the near future) and the Government finances looking a little squeaky, while the UK’s (and Leeds's) property market is enjoying a steadier footing, realistic pricing is the ultimate and most important thing in marketing a property. Remember last month, only 50.9% of homes that left estate agents' books ended up being sold and the homeowner moving (the rest being withdrawn from the market unsold). Of course, you might not get what you would've got a few years ago in the crazy years of 2020 and 2021, but the price you'll have to pay on the next one won't be as much either.

Back to news