SEARCH FOR PROPERTIES NOW...

Student

Professional

The Art of Pricing Properties Right

As we stand at the threshold of 2024, facing economic uncertainties and a shifting housing landscape, the significance of correct pricing in Leeds’ property market has never been more pronounced.

This comprehensive guide delves into the crucial aspects of property pricing and its profound impact on the property market transaction process.

Leeds’ Property Market: A Brief Overview

The Leeds property market presents a unique blend of historical charm and modern appeal. It caters to diverse preferences, from classic village properties and 19th-century homes to contemporary modern homes, from terraced homes, apartments, flats, maisonettes, and detached and semi-detached homes. However, this diversity brings with it the challenge of accurately valuing properties. Various factors, including economic shifts, transport links, schools, demographic changes, and national housing trends, have influenced the local Leeds market. Understanding these elements is essential for setting a price that reflects the property's worth and market conditions.

The Risks of Overpricing Your Leeds Home

One of the most common pitfalls in property sales is overpricing. This mistake often originates for two reasons.

The first is an emotional attachment to the property or the owner's misinterpretation of the market, so the owner’s hopes are over inflated for the local property market (remember, buyers haven’t got the emotional connection you have for your home).

The second is when estate agents overvalue properties to attract homeowner business; it poses significant risks and consequences for the homeowners. This practice, often driven by the desire to secure a listing, can lead to a misleading perception of the property's actual market value.

Overpriced Leeds Properties Tend to Remain on the Market for More Extended Periods

When a property is overpriced, it leads to what's often termed as 'listing fatigue.' This stagnation can create a negative perception among potential buyers, who may assume there are unspoken issues with the property.

This stagnation not only diminishes the property's appeal but can also necessitate subsequent price reductions, which may cast doubt on the property’s condition or desirability in the eyes of potential buyers.

Moreover, a property lingering unsold due to overvaluation can disrupt the homeowner's plans, whether purchasing a new home or relocating.

I recognise for the homeowner, an overinflated price tag initially seems appealing. Yet, it ultimately results in a prolonged period on the market, as the property fails to attract buyers at this unrealistic level and sometimes you have to drop your asking price below the market value six/nine months later to get it sold.

All these scenarios underscore the importance of choosing a Leeds estate agent who provides honest, market-reflective valuations from the outset, ensuring a smoother, more efficient sale process and safeguarding the homeowner's best interests.

The Downside of Under-pricing Your Leeds Home

Conversely, under-pricing a property, although potentially expediting a sale, can result in substantial financial loss for the seller. Setting a price too low in a market where maximising returns is paramount can mean significantly under-realising your Leeds property's actual market value. This scenario underscores the importance of expert valuation that considers all aspects of the property, including its potential in the current market.

Striking the Right Balance for Your Leeds Home

Accurate pricing is a delicate art that balances understanding a property's intrinsic value and aligning it with market trends. It involves thoroughly analysing local Leeds market conditions, comparative property studies, and awareness of broader economic factors.

Sellers should be looking for an agent who has a comprehensive understanding and in-depth knowledge of local markets to assist them in accurately pricing their properties. This approach is not just about facilitating quicker sales; it's about ensuring that properties are sold at their rightful value.

There is no harm in ‘trying the market’ at a slightly higher price in the initial stages of marketing. Yet, if you are going to try a slightly higher price, it is so important to have this monitored on a weekly basis in the first four to six weeks of the property being on the market and making any necessary changes to the asking price around that time.

There is such a thing as a Goldilocks price reduction. It shouldn’t be too little or too much, just right, so it gives a strategic price reduction.

Leeds House Price Reduction Stats

In a competitive property market, a strategic price reduction can reignite interest in a property. When used judiciously, this tactic attracts more potential buyers, sparking renewed attention and leading to a quicker sale. By adjusting the price to align with market trends and buyer expectations more closely, sellers can effectively boost the appeal and visibility of their property.

The rule of thumb is that if you try a slightly higher price in the initial stages of marketing, do so, at most, for a few weeks/one month, then reduce it. But how much should you reduce it by?

As always, that comes down to your property and its standing in the market.

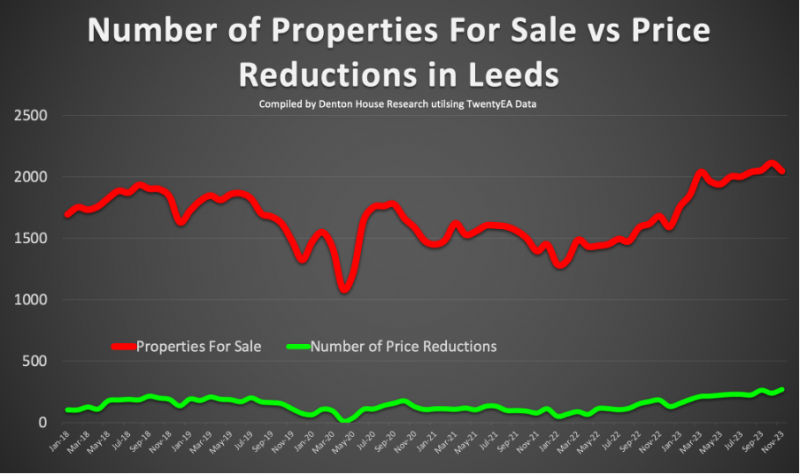

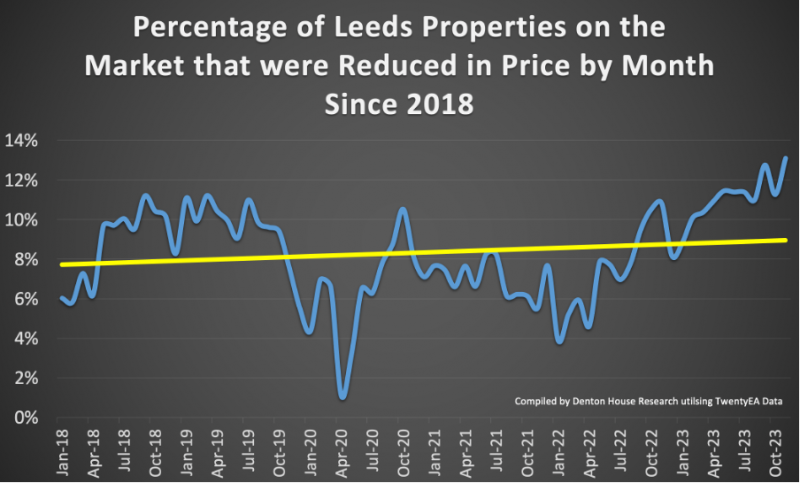

However, I wanted to share with you the level of price reductions in the Leeds area (LS1 to LS12) over the last six years.

In 2018, an average of 1,820 properties were for sale in the Leeds area. Estate agents reduced, on average, 164 properties per month; thus, 8.9% of Leeds homes were reduced in price every month.

In 2019, an average of 1,710 properties were for sale in the Leeds area. Estate agents reduced, on average, 165 properties per month; thus, 9.5% of Leeds homes were reduced in price every month.

In 2020, there were an average of 1,534 properties for sale in the Leeds area during the year. Estate agents reduced, on average, 103 properties per month; thus, 6.4% of Leeds homes were reduced in price every month.

In 2021, an average of 1,529 properties were for sale in the Leeds area. Estate agents reduced, on average, 107 properties per month; thus, 7.0% of Leeds homes were reduced in price every month.

In 2022, there were an average of 1,488 properties for sale in the Leeds area. Estate agents reduced, on average, 113 properties per month; thus, 7.4% of Leeds homes were reduced in price every month.

In 2023 (to the end of November), there have been an average of 1,982 properties for sale in the Leeds area during the year. Estate agents reduced, on average, 222 properties per month; thus, 11.1% of Leeds homes were reduced in price every month.

As you can see, there has been a substantial increase in properties on the market and thus price reductions in the Leeds area the last year.

The average reduction of a Leeds home in the last�three months has been 5.2%

Looking Ahead to the 2024 Leeds Property Market

As we advance into 2024, the Leeds property market, like many others, is navigating through a period marked by economic uncertainties and evolving buyer preferences. In this environment, realistic pricing is not merely a tactic for selling; it becomes a critical tool for differentiation in a competitive marketplace. Leeds properties priced in line with current market realities are more likely to attract serious buyers and foster successful home moves.

My final thoughts are that homeowners need to understand and master the art of property pricing, which is crucial in today's challenging and complex real estate market, especially in a diverse and evolving area like Leeds. Regardless of which estate agent you choose, remember that realistic and accurate pricing is the cornerstone of success in the current property landscape.

Back to news